Gift Aid can be challenging, there’s no denying it. Between labelling donations, all of the forms and explaining it to volunteers and customers multiple times a day – the time it takes to do all of this as well as process claims. Some may not even use Gift Aid for charities due to its seemingly complicated nature!

What if we were to tell you that we could cut out all of the paperwork, forms and explanations and replace it with one simple, affordable, tablet-based system.

So, let’s start from the very beginning and discuss how Wil-U can help you simplify your Gift Aid process.

What is Gift Aid for Charity Shops?

Simply put, Gift Aid allows charities to reclaim the tax on any donations received from a taxpayer. This includes the money they receive when selling donated goods. For every pound donated (or received from the sale of donated goods), the charity will receive £1.25.

This tends to be where Gift Aid for charity shops becomes a little complicated as essentially, donations of goods for sale through a charity shop or otherwise do not qualify for Gift Aid. However, a charity can offer to act as an agent for supporters and sell goods on their behalf. If the supporter agrees to donate the sale proceeds, and signs a Gift Aid declaration, that donation can then qualify for Gift Aid, under the Retail Gift Aid scheme.

Donated Goods and The Retail Gift Aid Scheme

Previously, shops were only able to claim Gift Aid on monetary donations…many still do. But, the Retail Gift Aid Scheme allows you to claim Gift Aid on proceeds from the sale of donated goods. The shop then acts as the donor’s ‘agent’ in selling the donated goods. The proceeds earned then belong to the donor who signs a declaration to agree to donating the proceeds of the sale to the charity.

Once the item sells, the charity must notify the donor and wait 21 days before processing the Gift Aid claim. Although the donor will have pre-agreed to the Gift Aid, this gives them the opportunity to notify if they have not paid enough tax within the current tax year. The charity may then process the Gift Aid Claim with HMRC.

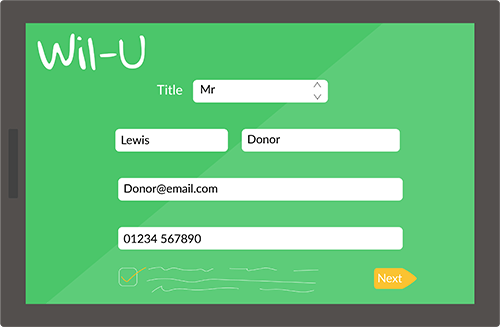

Gift Aid Sign-Up Forms

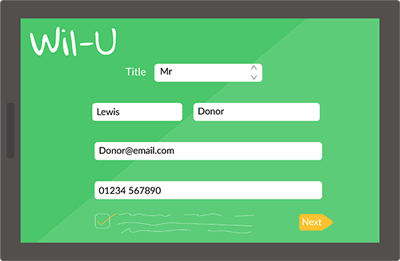

A simple Gift Aid declaration can be signed when the donor makes their first donation, this lasts around 4 years. However, the process can be daunting for donors and volunteers alike. Wil-U’s dedicated Gift Aid sign-up tablet replaces paper forms and collects all of the information needed and stores it securely. It then allows the donor to print the correct number of labels needed to stick on their bags. This means that when the volunteer comes to sorting the donation, they can simply print more labels for the individual items using the donor ID on the bag! Simple.

Lewis signs up for Gift Aid

Lewis prints labels

Volunteer Nina puts items out in shop

The processing and gift aid claim forms along with the spreadsheets and contacting donors can become overwhelming when you already have so much to do! Not only can it be time consuming, but spreadsheet formatting is not something that many people find easy.

When a charity pairs the digital Gift Aid sign-up tablet with the Gift Aid EPOS, your claims can be submitted with the touch of a button!

Wil-U’s Gift Aid Processing starts building claims for you in the correct format to submit to HMRC and even automatically contacts your donors, so you don’t have to individually email every single one.

Find out how you can replace paper forms with a tablet and increase donor sign ups by filling out the form below.

Light Years Ahead

Jul 20, 2021 2:31:00 PM

Comments